At IEQ Capital you get a highly experienced investment team, not just an individual adviser. As fiduciaries and community leaders, we prioritize the best interests of our clients and hold ourselves accountable to building a culture of integrity.

$36.5 Billion of Collectively Managed Regulatory Assets Under Management *

20+ Years that the core team has been together

240+ Of the best and brightest minds

* EPIQ and IEQ are under common control but operate independently. As of 12/31/24, the IEQ group manages $36.5bn in RAUM, with IEQ Capital at $30bn and EPIQ Capital Group at $6.3bn. IEQ RAUM as of 12/31/2023 as reported in IEQ Capital's Form ADV filed in March 2024 totaled $23.5bn. EPIQ RAUM as of 12/31/2023 as reported in EPIQ Capital Group's Form ADV filed in March 2024 totaled $4.94bn. RAUM includes currently managed assets as well as unfunded commitments to sponsored funds.

Our Team

Investors.

Business leaders.

At your service.

We are investors, not just advisers. We are independent and free from the limitations of larger financial institutions. These factors create a mutual incentive to provide investment opportunities tailored to your specific needs. Through clear communication and full transparency, we are dedicated to providing you with an exceptional client experience.

.png)

Awards & Recognition

- 2023 Forbes Best-In-State

- 2022 Forbes Best-In-State

- 2021 Forbes America’s Top 250

- 2021 Forbes Best-In-State

- 2020 Forbes America’s Top 250

- 2020 Forbes Best-In-State

- 2019 Forbes Best-In-State

*The awards listed are not endorsement of any third party to invest with IEQ and are not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

Alan Zafran

Founder, Managing Partner

Alan Zafran is a Co-Founder and Managing Partner of IEQ Capital and has served as a financial adviser to wealthy families and sophisticated investors for over three decades. Mr. Zafran also sits on the Investment Committee at IEQ Capital.

Mr. Zafran began his career at Goldman Sachs in the Private Client Group. After seven years at Goldman Sachs, Mr. Zafran and his entire team joined Merrill Lynch, where he helped to build the Private Banking and Investment Group. In 2008, Mr. Zafran co-founded Luminous Capital, an independent Registered Investment Advisory (RIA) firm. At Luminous, he served as a Portfolio Manager and investment committee member. Luminous Capital managed $5.5 billion of assets when it was acquired by First Republic Bank in 2012. At First Republic Bank, Mr. Zafran served as Senior Managing Director and Wealth Manager.

Mr. Zafran has been named one of "America's Top Wealth Advisors" by Forbes. Barron's named him one of "America's Top 100 Financial Advisors" and one of "America's Top 100 Independent Wealth Advisors”. IEQ Capital has also been recognized as one of "America's Top RIA Firms," by both Barron's and Forbes, citing Mr. Zafran as one of the Firm's top executives.

Mr. Zafran is active in his community - he is the Secretary, Treasurer, and a member of the Board of Directors, as well as serves on the Investment Committee for the Silicon Valley Community Foundation; is a member of the Board of Directors for Taube Philanthropies; serves as a member of the Board of Directors of the Filoli Center; serves as a member of the Board of Directors for the Shuchman Lesser Foundation; serves on the Investment Committee for the Board of Trustees of the Portola Valley School Foundation Endowment; and serves as a member of the Board of Trustees for the Craft Contemporary Museum.

Mr. Zafran holds a Bachelor of Arts and Science from Stanford University, Phi Beta Kappa, and MBA from Harvard Business School.

Awards & Recognition

- 2023 Forbes Best-In-State

- 2022 Forbes Best-In-State

- 2021 Forbes America’s Top 250

- 2021 Forbes Best-In-State

- 2020 Forbes America’s Top 250

- 2020 Forbes Best-In-State

- 2019 Forbes Best-In-State

*The awards listed are not endorsement of any third party to invest with IEQ and are not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

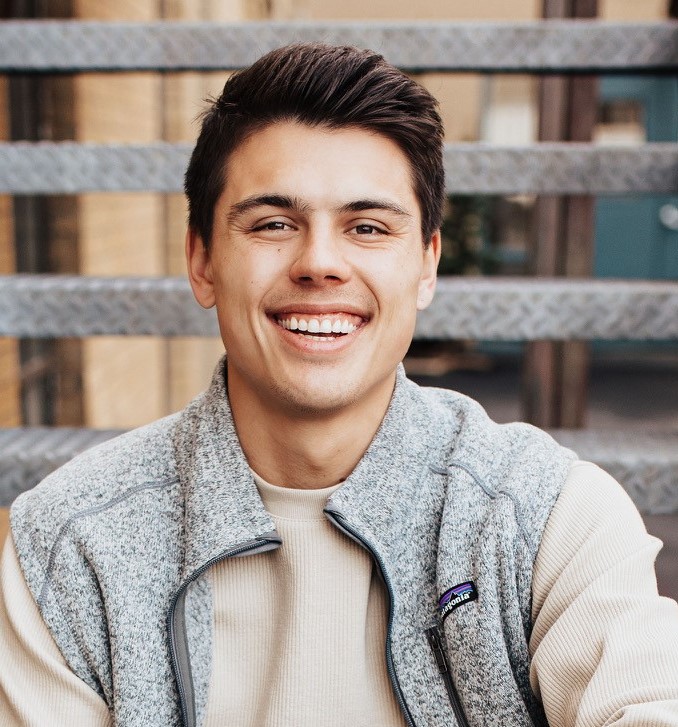

Alex Brugger

Senior Director

Alex Brugger is a Senior Director of IEQ Capital and he has provided investment advice to wealthy families, venture partners, and institutional investors for nearly a decade.

Mr. Brugger began his career in 2015 working in operations at First Republic Investment Management. In 2018, he transitioned to working with high-net-worth families directly at First Republic. In 2019, Mr. Brugger moved to IEQ Capital as he helped develop the firm and continue his career in financial services.

Mr. Brugger holds a Bachelor of Arts in Economics and Accounting from Claremont McKenna College.

He currently resides in Woodside, California with his family.

Alex Jack

Director

Alex Jack is a Director of IEQ Capital and has provided investment advice to wealthy families and institutional investors for seven years.

Mr. Jack began his career at First Republic Bank. In 2019, Mr. Jack transitioned to IEQ Capital as he helped develop the firm and continue his career in financial services.

Mr. Jack holds a Bachelor of Business Administration in Finance from Texas A&M University – Corpus Christi.

He currently resides in Walnut Creek, California.

(1).jpg)

Alex Webb

Associate Director

Alex Webb is an Associate Director at IEQ Capital, where he provides investment advice to wealthy families and individuals.

Mr. Webb has been working in the wealth and asset management industries for over five years. Prior to joining IEQ Capital, he worked for Dimensional Fund Advisors, a global asset management firm, where he consulted financial advisors on their investment offerings.

Mr. Webb holds a Bachelor of Science in Finance from Miami University in Oxford, Ohio.

Mr. Webb currently resides in Los Angeles, California.

Alexa Carrington

Director

Alexa Carrington is a Director of IEQ Capital, where she provides investment advice to wealthy families and institutional investors. She has nearly a decade of experience in the financial services industry.

Before joining IEQ Capital, Ms. Carrington spent most of her career in investor relations within the private investment sector. Most recently, she served as Vice President of Investor Relations at Roark Capital Group, an Atlanta-based private equity firm with $38 billion in AUM. Prior to that role, Ms. Carrington was the Vice President in the Investor Relations group at Avenue Capital Group, a global investments firm. Ms. Carrington also worked on the Investor Relations team at Corbin Capital Partners, an alternative asset management firm specializing in multi-strategy hedge fund and opportunistic credit investing. Ms. Carrington started her career at SunTrust Robinson Humphrey, where she was an investment banking analyst in the Consumer and Retail group.

Ms. Carrington graduated magna cum laude from the University of Georgia with a Bachelor of Business Administration in Finance and a minor in Political Science.

She is an Atlanta, Georgia native, where she currently resides with her husband.

Andrew Venturi

Managing Director

Andrew Venturi is a Managing Director of IEQ Capital and has provided investment advice to wealthy families and institutional investors for nearly 15 years.

Prior to joining IEQ Capital, Mr. Venturi served as a Managing Director of Sepio Capital where he worked closely with ultra-high-net-worth clients to devise and implement wealth strategies that respond to their unique priorities and needs. Prior to joining Sepio capital, Mr. Venturi was a Senior Vice President at Merrill Lynch Private Bank. He also served clients at Credit Suisse Private Bank, Barclays Wealth, United Capital, now Goldman Sachs. Mr. Venturi is experienced in customized strategies in multiple disciplines: investment management, wealth transfer, credit and lending, institutional services, and philanthropy.

Mr. Venturi earned his Bachelor of Science in Marketing from the University of Arizona’s Eller School of Business.

He is a Bay Area native, and he currently resides in the San Francisco Bay Area with his wife and son.

Angus Smith

Director

Angus Smith is a Director of IEQ Capital and has provided investment advice to wealthy families and institutional investors for six years.

Mr. Smith began his career as an analyst at Hall Capital Partners in 2019 before transitioning to IEQ Capital in 2022.

Mr. Smith is a member of the Summer Search Bay Area Associate Board and has served as a volunteer tutor for the SMART Program. These groups both provide mentorship and tutoring services to under-served youth in the Bay Area.

Mr. Smith holds a Bachelor of Science in Economics and Mathematics and a minor in Spanish from the University of Southern California.

Ann Dam

Associate Director

Ann Dam is an Associate Director of IEQ Capital and has worked closely with our Founding Partners for five years.

Ms. Dam began her career as an Investments Administrative Assistant at Silicon Valley Community Foundation.

Ms. Dam holds a Bachelor of Arts in Business Economics from the University of California, Irvine.

Ms. Dam resides in Menlo Park, California. She enjoys trying new restaurants, baking and spending time with her cat, Shu.

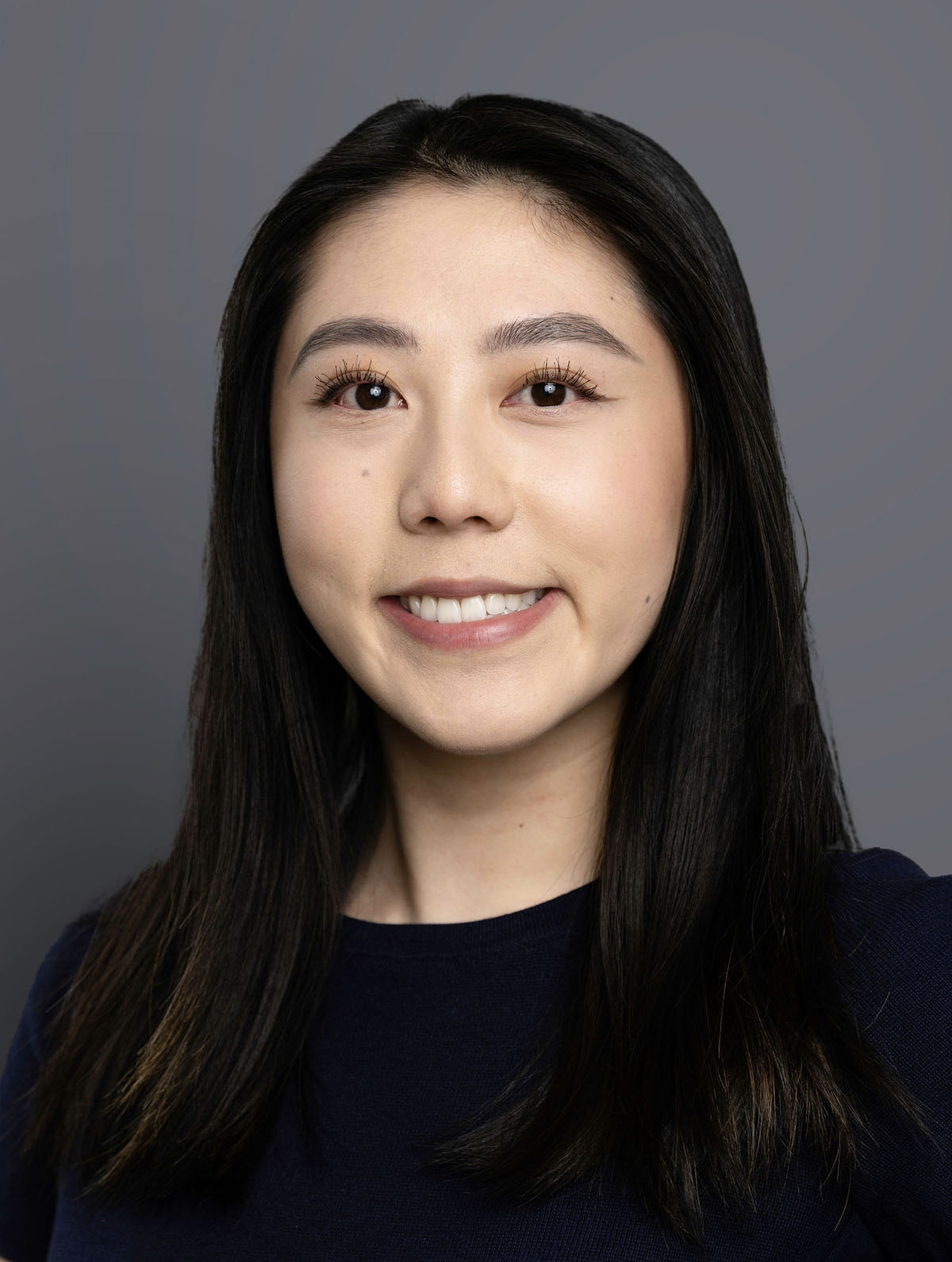

Ann Luo

Director

Ann Luo is a Director of Compliance at IEQ Capital. In her role, Ms. Luo supports the General Counsel and Chief Compliance Officer on legal and compliance matters concerning the firm. She is also involved in valuable firm initiatives by sitting on the Advisory Board for IEQ's Diversity, Equity, and Inclusion (DEI) Committee.

Ms. Luo began her career as an Audit Senior at Deloitte, where she managed audits of registered investment companies.

Ms. Luo holds a Bachelor of Science in Business Administration from Boston University. Additionally, Ms. Luo holds a Certified Public Accountant designation.

Ms. Luo lives in San Francisco, California and enjoys jogging, traveling, and spending time with friends and family.

.jpg)

Anna Povinelli

Deputy Chief Compliance Officer

Anna Povinelli is the Deputy Chief Compliance Officer at IEQ Capital, where she oversees compliance strategy and regulatory initiatives to uphold the firm’s commitment to fiduciary duty, integrity and client service. Ms. Povinelli brings over 30 years of experience in finance and compliance, with a focus on regulatory consulting and advisory services.

Prior to joining IEQ Capital, Ms. Povinelli served as Managing Director and Co-Head of the Compliance and Regulatory Consulting practice at Kroll, where she spent nearly a decade providing strategic compliance solutions for clients in complex regulatory environments. She also held the role of Chief Compliance Officer at both Bristol Investment Partners and Admiral Capital Management, where she developed and maintained comprehensive risk-based compliance programs. Earlier in her career, Ms. Povinelli held key positions at Bloomberg, AEW, and KPMG, gaining expertise in financial analysis, investor relations, and audit.

Ms. Povinelli is involved in several community and health-related organizations.

Ms. Povinelli holds a Bachelor’s degree in Business Administration, Management, and Accounting from Northeastern University.

Ms. Povinelli is an avid runner having completed 26 marathons. She also enjoys skiing, golf, pickle ball and most outdoor activities.

Ben Steed, CFA

Managing Director

Ben Steed is a Managing Director of IEQ Capital and has provided investment advice to wealthy families and institutional investors for nearly 15 years.

Prior to joining IEQ Capital, Mr. Steed served as a Managing Director of Sepio Capital where he worked closely with ultra-high-net-worth clients to provide them with holistic wealth management services with a focus on investment advice, asset allocation and portfolio construction recommendations. Mr. Steed began his career at Merrill Lynch where he served as a Financial Analyst.

Mr. Steed received his Bachelor of Science in Business Management with an emphasis in finance from Brigham Young University. He also holds the Charted Financial Analyst (CFA) designation.

Mr. Steed resides in the San Francisco Bay Area with his wife and two children.

Bethany Peterson

Partner, Chief Financial Officer

Bethany Peterson is a Partner and Chief Financial Officer of IEQ Capital where she oversees the accounting, finance, and FP&A reporting functions within the Firm. She has nearly two decades of experience working in the financial services industry.

Prior to joining IEQ Capital, Ms. Peterson served as the Vice President of Finance at GI Partners, a San Francisco-based private investment firm with over $14 billion in AUM across private equity, data infrastructure and real estate strategies. In her role she oversaw the reporting and operating functions of the private equity funds, the GP entities, and the management company. While at GI Partners, Ms. Peterson partnered with the investment teams providing operational support for acquisitions and realizations of over 20 portfolio companies and assisted in the diligence and execution of the minority transaction to Blackstone Strategic Capital Group.

Ms. Peterson started her career at Deloitte & Touche LLP, where she provided asset management assurance services primarily within the Private Equity industry.

Ms. Peterson holds a Bachelor of Science in Business Economics, emphasis in Accounting, from the University of California, Santa Barbara, and is a Certified Public Accountant (non-active) in the state of California.

She is a Bay Area native and resides in Lafayette, California with her husband and two daughters.

Bhavika Booragadda

Senior Director

Bhavika Booragadda is a Senior Director of Research at IEQ Capital and is responsible for sourcing and conducting due diligence for new investments in addition to monitoring the existing portfolio of alternative investments.

Ms. Booragadda began her career as an Associate at First Republic Bank. In 2019, Ms. Booragadda transitioned to IEQ Capital as she helped develop the firm and continue her career in finance.

Ms. Booragadda serves as the chair of IEQ’s Diversity, Equity, and Inclusion (DEI) Committee.

Ms. Booragadda holds a Bachelor of Science in Mathematics and Economics from Claremont McKenna College.

Ms. Booragadda grew up in India and she currently resides in the Bay Area with her husband. In her free time, Ms. Booragadda enjoys playing tennis and travelling.

.jpg)

Brendon Kempin

Director

Brendon Kempin is a Director at IEQ Capital and has provided investment advice to wealthy families and institutional investors for six years.

Mr. Kempin began his career as a client service associate at First Republic Bank in 2018. In 2019, Mr. Kempin transitioned to IEQ Capital to help build the firm and continue his career in financial services.

Mr. Kempin holds a Bachelor of Business Administration in Finance and Entrepreneurship from the University of Notre Dame, where he also served as captain of the Varsity Men’s Tennis Team.

.jpg)

Cam Croteau

Director

Cam Croteau is a Director of IEQ Capital and has provided investment advice to wealthy families and institutional investors for over five years.

Mr. Croteau began his career in PwC’s financial advisory practice. In 2019, Cam transitioned to IEQ Capital as he helped develop the firm and continue his career in financial services.

Mr. Croteau holds a Bachelor of Science degree in Economics from the Morrissey College of Arts & Sciences at Boston College where he was also a member of the Division I football team.

Cameron Smith, CFA

Director

Cameron Smith is a Director at IEQ Capital and provides customized investment and planning advice to wealthy families and institutional investors.

Prior to joining IEQ, Mr. Smith spent eight years at UBS Private Wealth Management where he provided specialized investment and estate planning advice to ultra-high-net-worth clients.

Mr. Smith graduated from the University of Denver with a degree in finance and holds the Chartered Financial Analyst (CFA) designation.

Mr. Smith resides in Los Gatos, California with his wife, daughter and two dogs.

Casey Beyel

Senior Director

Casey Beyel is a Senior Director of IEQ Capital and has provided investment advice to high-net-worth families and sophisticated investors for four years.

Ms. Beyel started her career in finance as Director at First Republic Bank and transitioned to IEQ Capital to further her career in financial services and help develop the firm. Prior to that, Ms. Beyel spent three years in high-net-worth-client services at Wheels Up.

Ms. Beyel holds a Bachelor of Arts in Sociology and a Certificate in Markets and Management from Duke University where she was also a member of the Division I field hockey and lacrosse teams. Additionally, Ms. Beyel holds a Masters in Management Studies from the Fuqua School of Business at Duke University.

Catherine Li

Director

Catherine Li is a Director and Assistant Controller at IEQ Capital and is responsible for finance and accounting operations and data in addition to supporting the Chief Financial Officer. She has worked in financial services for over a decade.

Ms. Li began her career in accounting for various real estate investment firms, including TDA Investment Group, Pisces and SPI Holdings.

Ms. Li holds a Bachelor of Science degree in Management Science with a minor in International Studies from the University of California, San Diego.

Ms. Li resides in the Bay Area with her husband and two daughters.

Christian Nelson

Partner

Christian Nelson is a Partner of IEQ Capital and has provided investment advice to wealthy families and institutional investors for over two decades. He also serves on the Investment Committee of IEQ Capital.

Mr. Nelson began his career as an Advisor with Merrill Lynch in 1999 and has held positions with Zacks Investment Management and Fidelity Investments prior to joining the team at First Republic Bank in 2015. At First Republic Bank, Mr. Nelson served as a Senior Vice President and Wealth Manager.

Mr. Nelson received his Bachelor of Science in Engineering from Worcester Polytechnic Institute.

He resides in Bellevue, Washington with his wife and three children.

Christie Olsson

Managing Director, Senior Wealth Strategist

Christie Olsson is a Managing Director, Senior Wealth Strategist at IEQ Capital where she works with clients to develop wealth transfer plans and implement solutions based on a thorough understanding of each client’s personal values, estate planning goals, and legacy vision.

Prior to joining IEQ Capital, Ms. Olsson served as an Executive Director, Senior Wealth Strategist at UBS where she specialized in developing custom wealth plans for clients in addition to serving as a resource on matters of estate, tax, philanthropy and business planning. Prior to that, Ms. Olsson advised high-net-worth clients as a Vice President of Wells Fargo Bank. Additionally, Ms. Olsson served as Counsel at Schiff Hardin LLP where she advised high-net-worth clients on various aspects of their estate plan. Ms. Olsson began her career as an attorney for Aaron, Riechert, Carpol, Riffle and then with Pillsbury, Winthrop, Shaw, Pittman.

Ms. Olsson works with her clients on every stage of a planning engagement, from discussing foundational documents to designing more sophisticated wealth-shifting and preservations vehicles such as spousal lifetime access trusts, intentionally defective grantor trusts, and incomplete non-grantor trusts, as well as the ongoing administration of those strategies. Given her base in the Bay Area, Ms. Olsson has extensive experience planning for illiquid assets, including real estate, founder shares, QSBS, stock options, and carried interest.

Ms. Olsson received her Juris Doctor from Santa Clara University School of Law and her Bachelor of Arts in Economics and Environmental Studies from Lewis and Clark College in Portland, Oregon. She is a member of the California State Bar as well as the Trusts & Estates Section and Taxation Section of the California Lawyers Association in addition to being a State Bar of California certified specialist in Estate Planning, Trust & Probate Law.

Ms. Olsson resides in the Bay Area with her daughter and coaches pole vault for a local Bay Area high school.

It is important to remember that IEQ and its employees do not provide tax, legal, or other advice. Clients should consult with their legal and tax advisors regarding their personal circumstances.

.jpg)

Christina Flamer, CPA

Financial Controller

Christina Flamer is a Financial Controller at IEQ Capital and has worked in financial services for fifteen years.

Ms. Flamer began her career working with clients in financial planning at State Farm. After two years, Ms. Flamer joined the Finance team at Northgate Capital, reporting on FOF investments within venture capital, private equity, and emerging markets. In 2015, Ms. Flamer joined DivcoWest, a multidisciplinary investment firm focused on real estate, where she built out the fund accounting team and acted as an Accounting Manager. In 2022, Ms. Flamer transitioned to IEQ Capital.

Ms. Flamer is an active supporter of organizations that speak to her passions - including The City Eats, ASPCA, and ChildFund. She provided CFO-level services pro bono for several nonprofit organizations and local distressed businesses in the Bay Area during the pandemic. Ms. Flamer also volunteers for the Children’s Ministry at Lineage Church in El Cerrito, California.

Ms. Flamer holds a Bachelor of Arts degree in Economics and Spanish from Mount Holyoke College and holds the Certified Public Accountant designation.

Ms. Flamer lives in Oakland, California, with her three dogs.

Colin Mark-Griffin, CAIA

Managing Director

Colin Mark-Griffin is a Managing Director of Research at IEQ Capital, managing the research team and focusing on ongoing due diligence and the pipeline of new investments.

Before IEQ Capital, Mr. Mark-Griffin spent eight years with Welton Investment Partners, a multi-strategy hedge fund where he served on the Investment Committee. He was the Head of Trading and aimed to optimize execution strategies in equity derivatives, futures, and foreign exchange markets.

Mr. Mark-Griffin holds a Bachelor of Arts in Business Managerial Economics from the University of California, Santa Cruz, and an MBA from the University of California, Berkeley Haas School of Business. He holds the Chartered Alternative Investment Analyst (CAIA) designation.

He lives in San Francisco, California, with his wife and two kids.

Corinne Birriel

Director

Corinne Birriel is the Director of Marketing at IEQ Capital where she supports the firm's goals and initiatives across client experience and brand management.

Ms. Birriel began her career at Harris Williams, a global M&A advisor. Ms. Birriel initially worked on M&A transactions in the Consumer space before transitioning to relationship management across West Coast private equity groups. In 2020, Ms. Birriel joined IEQ Capital as a Senior Associate of Business Development before transitioning to Marketing.

Ms. Birriel holds a Bachelor of Science in Hospitality Management & Business from James Madison University.

Ms. Birriel lives in San Francisco, California and enjoys running, culinary experiences, and spending time with her dog, Rocky.

Daniel Hill

Director

Daniel Hill is a Director of IEQ Capital and has provided investment advice to wealthy families and institutional investors for two years.

Mr. Hill began his career as a Senior Associate at IEQ Capital. Prior to joining IEQ Capital, Mr. Hill worked as an intern with Goldman Sachs in the Investment Management Division.

Mr. Hill holds a Bachelor of Arts degree in Economics from Pomona College.

He currently resides in San Francisco, California.

Daniel Lee

Managing Director

Daniel Lee is a Managing Director at IEQ Capital and has provided investment advice to wealthy families and individuals for two decades.

Mr. Lee previously served as a Partner, Wealth Advisor and the Chief Revenue Officer of Certuity. Prior to joining Certuity, Mr. Lee spent ten years at First Republic Bank as a Senior Managing Director and Wealth Advisor, advising ultra-high-net-worth families. He also served on the bank’s Leadership Committee and managed wealth advisory services for the Pacific Northwest. Before that, he was a Private Client Advisor at U.S. Trust, offering counsel on investment strategy, asset allocation, and multi-generational wealth planning. Additionally, he worked as a Financial Advisor at Merrill Lynch and in private equity and real estate at a Multi-Family Office.

Mr. Lee currently serves on the board of Bring Change to Mind, a nonprofit organization that is dedicated to encouraging dialogue about mental health across the nation.

Mr. Lee graduated with honors from the University of Arizona’s Eller College of Business with a Bachelor of Science in Business Management. He also received a minor in International Business from Lorenzo de’ Medici in Florence, Italy.

Mr. Lee resides in California with his wife and son.

Danny Nowak

Senior Director

Danny Nowak is a Senior Director of IEQ Capital and has provided investment advice to wealthy families and institutional investors for nearly a decade.

Mr. Nowak began his career in Ernst & Young’s financial advisory practice before transitioning to First Republic Bank in 2018 to continue his career in financial services. In 2019, Mr. Nowak transitioned to IEQ Capital as he helped develop the firm and continue his career in financial services.

Mr. Nowak holds a Bachelor of Science degree in Finance from the Olin Business School at Washington University in Saint Louis where he was also a member of the Football team.

Mr. Nowak is originally from Chicago, Illinois and he currently resides in Los Angeles, California.

Dean Horwitz

Partner, Chief Operating Officer

Dean Horwitz is a Partner and Chief Operating Officer of IEQ Capital where he designs and implements all day-to-day administrative and operational functions of the business.

Mr. Horwitz began his career working alongside the IEQ Capital Founding Partners while at Luminous Capital, an independent Registered Investment Advisory firm. Luminous Capital managed $5.5 billion of assets when it was acquired by First Republic Bank in 2012. At First Republic Bank, Mr. Horwitz served as Senior Vice President and Co-COO of his division where he was the head of performance reporting and led the firm’s technology stack integration and user adoption, as well as the sunsetting of legacy systems.

Mr. Horwitz holds a Bachelor of Science degree with honors in Business Administration from the University of California, Berkeley where he was on the varsity rowing team.

Mr. Horwitz enjoys cycling and taking his dog, Zin, out for walks in his free time. He currently resides in Redwood City, California with his wife.

Dominic Tanouye-Wolf

Associate Director

Dominic Tanouye-Wolf is an Associate Director on the Finance Team at IEQ Capital. In this role, he is responsible for overseeing all aspects of billing and collections. He manages both accounts receivable the revenue data for all clients, ensuring its accuracy for inclusion in the Finance team's dashboarding and reporting processes. He collaborates with cross-functional teams to identify and implement process improvements, aiming to enhance operational efficiency and scalability.

Before joining IEQ, Mr. Tanouye-Wolf worked at RingCentral as a Billing and Finance Operations Analyst. In this capacity, he gained broad experience in various aspects of billing and finance operations. This included ensuring billing accuracy and resolving billing inquiries, as well as supporting the development and testing of system updates and enhancements to improve the overall efficiency and functionality of our billing platform.

Mr. Tanouye-Wolf received his Bachelor’s degree in Finance from Washington State University, where he developed a strong foundation in financial principles and analytical skills.

Doug Poetzsch, CFA

Director

Doug Poetzsch is a Director of IEQ Capital and has provided investment advice to wealthy families and institutional investors for over a decade.

Before joining IEQ Capital, Mr. Poetzsch was a founding member of Citi Private Bank's Atlanta team. At Citi Private Bank, Mr. Poetzsch served as a Senior Vice President and Investment Counselor, tailoring customized portfolios, asset allocation, manager selection, trade ideas, and conducting deal flow diligence for ultra-high net worth families, entrepreneurs, and foundations. Prior to working in the Private Bank, Mr. Poetzsch worked on a variety of desks in Citi's Sales & Trading program.

Mr. Poetzsch graduated cum laude from Washington and Lee University with a Bachelor of Science in Accounting, Business Administration, and Economics. He also played on the university's basketball team.

In his free time, Mr. Poetzsch enjoys endurance events, cycling, and coaching his kid's basketball and baseball teams. He has completed two marathons, ten half marathons, one triathlon, and many more destination cycling rides.

Mr. Poetzsch currently resides in East Cobb, Georgia with his wife and three children.

Awards & Recognition

- 2019 Forbes Best-In-State NJ

- 2018 Forbes Next Generation

*The awards listed are not endorsement of any third party to invest with IEQ and are not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

Forbes' wealth advisor ranking is developed by SHOOK Research, an independent research firm. The ranking is based on an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. Those advisors that are considered have a minimum of seven years' experience, and the algorithm weighs factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings. More information can be found here.

DW Kim, CFP

Senior Director

DW Kim is a Senior Director of IEQ Capital and has provided investment advice to wealthy families and institutional investors for over a decade.

Mr. Kim began his career at Morgan Stanley in 2009 as Associate Vice President of Wealth Management. There, he also served as Portfolio Manager to high-net-worth families and institutions, creating customized investment solutions for their financial needs. After 11 years at Morgan Stanley, Mr. Kim transitioned to IEQ Capital.

Mr. Kim has been named one of “America’s Top Next-Gen Wealth Advisors” and “Best-in-State Next-Gen Wealth Advisors” by Forbes.

Mr. Kim is the Board Treasurer of RCF Connects, a non-profit that mobilizes the power of connection to build healthy, thriving, and equitable communities throughout Contra Costa County. Mr. Kim also sits on the DEI Committee of IEQ Capital.

Mr. Kim holds a Bachelor of Arts in Statistics from Rutgers University and has earned the Certified Financial Planner TM (CFP) designation.

Mr. Kim lives in the East Bay of California with his wife and son. In addition to finance, he enjoys reading, culinary arts, and travel.

Awards & Recognition

- 2019 Forbes Best-In-State NJ

- 2018 Forbes Next Generation

*The awards listed are not endorsement of any third party to invest with IEQ and are not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

Forbes' wealth advisor ranking is developed by SHOOK Research, an independent research firm. The ranking is based on an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. Those advisors that are considered have a minimum of seven years' experience, and the algorithm weighs factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings. More information can be found here.

.png)

Dylan Kremer

Managing Director

Dylan Kremer is a Managing Director at IEQ Capital and has provided investment advice to wealthy families and individuals for over a decade.

Mr. Kremer previously served as the Chief Investment Officer at Certuity, where he worked closely with advisors, investment analysts, and clients on portfolio architecture, asset allocation, investment selection, and alternative investment due diligence and selection. Prior to joining Certuity, Mr. Kremer served as a Managing Director of Investment Strategy at Cresset Capital, where he focused on multi-asset class and macroeconomic research, portfolio construction, and managing tactical asset allocation decisions. Mr. Kremer also ran the OCIO and Investment Consulting business. Before Cresset Capital, Mr. Kremer was the lead macro strategist within the wealth management group at the Bank of Montreal (BMO) Financial Group. He started his career at J.P. Morgan, working across the Private Bank and Investment Bank.

Mr. Kremer is actively involved in his community. He is the Founder & CEO of Chicago Basketball Club, LLC, a basketball training company for players of all ages and skill levels, including NBA players.

Mr. Kremer graduated magna cum laude from Loyola University with a Bachelor of Business Administration in Finance. He played on the men’s basketball team all four years and was an Academic All American.

Awards & Recognition

- 2022 Forbes Best-In-State

- 2021 Forbes Best-In-State

- 2020 Forbes Best-In-State

- 2019 Forbes Best-In-State

*The awards listed are not endorsement of any third party to invest with IEQ and are not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

The Forbes ranking of Best-in-State Wealth Advisors and America’s Top Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative criteria learned through telephone, virtual and in-person due diligence interviews, and quantitative data such as revenue trends and assets under management. The algorithm additionally weighs factors such as service models, compliance records and industry experience, and focuses on those that encompass best practices in their approach to working with clients. All advisors that are considered have a minimum of seven years experience. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings. More information can be found here: https://lnkd.in/gZnGua5G

The award listed is not an endorsement of any third party to invest with IEQ and is not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

Eric Harrison

Founder, Managing Partner

Eric Harrison is a Founder and Managing Partner of IEQ Capital, having served as a financial adviser to wealthy families and foundations since 2008. He is responsible for identifying and structuring alternative investments, constructing client portfolio allocation, implementing tax strategies, and managing overall firm operations. Prior to founding IEQ, Mr. Harrison served as CEO of our predecessor firm, Luminous Capital, founded in 2008 and acquired by First Republic Bank in 2012. Mr. Harrison has been named a "Best-in-State Wealth Advisor" by Forbes as well as one of "America's Top 100 Independent Wealth Advisors" by Barron’s.

Before working within wealth management, Harrison was a principal investor for over 15 years. He first spent seven years in venture capital, ultimately serving as a Partner at Crosspoint Venture Partners, followed by eight years leading controlled buyout investments as a Founding Senior Partner at GI Partners.

Mr. Harrison has raised over $10 billion in alternative investment capital, comprised of commitments to all segments of commercial real estate, growth equity, buyouts, and specialized strategies, including equipment leasing, luxury resorts, and distressed credit funds.

Mr. Harrison has served on numerous corporate and non-profit boards. He currently serves on over 20 limited partner advisory boards, including funds managed by Fortress, Blackstone, Francisco Partners, CB Richard Ellis Investors, Oak Street Partners, Cerberus, and Prime Finance.

Mr. Harrison holds a Bachelor of Science from the University of Colorado and MBA from the UCLA Anderson School of Management.

Awards & Recognition

- 2022 Forbes Best-In-State

- 2021 Forbes Best-In-State

- 2020 Forbes Best-In-State

- 2019 Forbes Best-In-State

*The awards listed are not endorsement of any third party to invest with IEQ and are not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

The Forbes ranking of Best-in-State Wealth Advisors and America’s Top Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative criteria learned through telephone, virtual and in-person due diligence interviews, and quantitative data such as revenue trends and assets under management. The algorithm additionally weighs factors such as service models, compliance records and industry experience, and focuses on those that encompass best practices in their approach to working with clients. All advisors that are considered have a minimum of seven years experience. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings. More information can be found here: https://lnkd.in/gZnGua5G

The award listed is not an endorsement of any third party to invest with IEQ and is not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

Frank Lankford

Managing Director

Frank Lankford is a Managing Director of IEQ Capital, and he has served as a financial adviser to wealthy families and institutional investors for nearly two decades.

Mr. Lankford joins IEQ from Citi Private Bank in Atlanta, where he helped establish the Southeast office for the Private Bank and was responsible for delivering the firm’s investing, wealth transfer, credit and philanthropic services to ultra-high-net-worth clients. Previously, Mr. Lankford worked for J.P. Morgan Private Bank working with high-net-worth families. Prior to the seven years at J.P Morgan, Mr. Lankford worked at Morgan Keegan as an Institutional Equity Sales Trader. In this role, he worked with institutions while providing clients with research, analysis and trading execution.

Mr. Lankford is an active supporter of Covenant House Georgia and City of Refuge Atlanta.

Mr. Lankford graduated from the University of Virginia with a Bachelor's in Political Science and received his MBA in Finance from the Goizueta Business School at Emory University.

Frank McFarland

Founding Partner

Frank McFarland is a Founding Partner of IEQ Capital and has provided investment advice to wealthy families and institutional investors for more than two decades. He also serves on the Investment Committee of IEQ Capital.

Mr. McFarland began his career as an Investment Consultant to high-net-worth individuals at Fidelity Investments. In 2006, he joined Merrill Lynch as a Financial Analyst in the Private Banking and Investment Group. In 2008, Mr. McFarland co-founded Luminous Capital, an independent Registered Investment Advisory firm. At Luminous, he served as a Financial Adviser and member of the Investment Committee. Luminous Capital managed $5.5 billion of assets when it was acquired by First Republic Bank in 2012. At First Republic Bank, Mr. McFarland served as a Senior Vice President and Wealth Manager.

Active in the community, Mr. McFarland and his wife proudly support Upward Bound House, which provides housing and support services for homeless families in the Los Angeles area.

Mr. McFarland received his Bachelor of Science in Accounting from Syracuse University and serves on the SU Los Angeles Alumni Counsel.

Mr. McFarland lives in Santa Monica, California with his wife and daughter.

Garret Giglia, CFA

Partner

Garret Giglia is a Partner of IEQ Capital and has provided investment advice to wealthy families and institutional investors for 15 years. He also serves on the Investment Committee of IEQ Capital.

Mr. Giglia began his career in Public Accounting working in the Audit and Advisory practice at Windes & McClaughry. After earning his Certified Public Accountant designation (currently inactive) and spending 3 years at Windes & McClaughry, he joined the institutional asset management team at Pacific Life where he was responsible for making buy/sell recommendations on the underlying credit investments of the broader investment portfolio. In 2012, he joined the Private Banking and Investment Group (“PBIG”) at Merrill Lynch, shifting his focus from institutional investment management to high-net-worth wealth management. In 2016, Mr. Giglia joined First Republic Bank, serving as Senior Vice President and Wealth Manager.

Mr. Giglia holds a Bachelor of Science degree in Accounting from the University of Southern California. Mr. Giglia holds the Chartered Financial Analyst (CFA) designation.

Mr. Giglia lives in Los Angeles, California with his wife and two sons.

Greg Heiser

Director

Greg Heiser is a Director at IEQ Capital where he manages the Performance team. He oversees the firm’s performance reporting platform while designing and implementing data-related enhancements across various business units.

Mr. Heiser began his career at Fisher Investments, a Registered Investment Advisory firm, working in data analytics and research. Mr. Heiser first joined IEQ Capital in 2020, focusing on data management, driving efficiencies across the operations department to support the firm's growth, and leading key performance reporting initiatives.

Mr. Heiser holds a Bachelor’s Degree in Economics from San Diego State University.

Mr. Heiser resides in San Jose, California with his wife, son, and golden retriever, Luna.

Gustavo Pires

Associate Director

Gustavo Pires is an Associate Director at IEQ Capital and has provided investment advice to wealthy families, charitable organizations, and institutional investors for seven years.

Prior to joining IEQ Capital, Mr. Pires spent five years at Portola Partners where he advised ultra-high-net-worth families through various investment strategies and life events in his role as a manager. He also spent one year at Qualcomm Ventures investing in deep tech, early-stage companies that leveraged wireless communication technologies.

Mr. Pires holds an MBA from the Kellogg School of Management with a concentration in finance, and a Bachelor of Arts in Economics and Philosophy from Claremont McKenna College.

He is originally from Brazil and lives in Los Angeles, California with his wife and dogs.

Haldo Cabrera

Associate Director

Haldo Cabrera is an Associate Director at IEQ Capital and has provided investment advice to wealthy families and institutional investors for nearly a decade.

Mr. Cabrera began his career as an Associate at Citi Private Bank on the Investments team.

Mr. Cabrera holds a Bachelor of Science in Business Administration and Accounting from the University of Southern California.

Mr. Cabrera is originally from Miami, Florida and he currently lives in Burlingame, California. He enjoys basketball, running, lifting weights, traveling, and trying new restaurants.

Harry Guilfoyle

Partner, Business Development & Investment Platform and Risk Management

Harry Guilfoyle is a Partner of IEQ Capital overseeing the Business Development and Platform Management teams.

Mr. Guilfoyle began his career working alongside the IEQ Capital Founding Partners while at First Republic Investment Management. At First Republic, Mr. Guilfoyle served as Vice President and provided investment advice to wealthy families.

Mr. Guilfoyle holds a Bachelor of Arts degree in Public Policy from Duke University.

He is a Bay Area native and resides in Redwood City, California with his wife and daughter.

Ian Linford

Partner

Ian Linford is a Partner of IEQ Capital and has provided investment advice to wealthy families and institutional investors for 11 years. He also serves on the Investment Committee of IEQ Capital.

Mr. Linford began his career working alongside the IEQ Capital Founding Partners while at Luminous Capital, an independent Registered Investment Advisory firm. Luminous Capital managed $5.5 billion of assets when it was acquired by First Republic Bank in 2012. At First Republic Bank, Mr. Linford served as Senior Vice President and Wealth Manager while also taking an active role in alternative investment due diligence and managed a team of 20 client-facing individuals.

Mr. Linford is a member of the Investment Committee of Silicon Valley International School in Palo Alto, California. He is the Investment Committee Chair for the Elizabeth F. Gamble Garden in Palo Alto, California.

Mr. Linford holds a Bachelor of Arts degree in Economics from Stanford University.

Mr. Linford is a Federal Aviation Administration certified Private Pilot. He lives with his wife and daughter in Redwood City, California.

Jake Lenett

Associate Director

Jake Lenett is an Associate Director at IEQ Capital, where he began his career in 2021 providing investment advice to high-net-worth families. With a deep passion for the subject matter, Mr. Lenett transitioned to IEQ Capital's Research department, where he supports the firm's efforts to diligently identify, understand, and build-out potential opportunities for clients.

Mr. Lenett holds a Bachelor of Science degree in Finance from Elon University. In his free time, he is an avid reader, with a particular interest in history, geopolitics, and business topics.

Mr. Lenett is a San Francisco, California native, and currently resides in Burlingame, California.

Jeff Sawin

Managing Director

Jeff Sawin is a Managing Director of IEQ Capital and has provided investment advice to high-net-worth families and institutional investors for seven years.

Mr. Sawin began his career as a Junior Officer in the U.S. Navy in 2008 upon graduation from the U.S. Naval Academy. During his six years on active duty, Mr. Sawin served onboard the guided missile destroyer, USS KIDD, in the U.S. Special Operations Command, and in new officer recruiting. Upon completing his service, Mr. Sawin joined Goldman Sachs as a Private Wealth Advisor in San Francisco, California. During his time there, he ran a team that provided holistic wealth management services for wealthy individuals and their families with a focus on investment advice, asset allocation and portfolio construction recommendations.

Mr. Sawin holds a Bachelor of Science from The U.S. Naval Academy at Annapolis where he was a member of the varsity golf team and captain of the varsity squash team. He earned his MBA from The University of Chicago Booth School of Business.

Mr. Sawin loves to spend time with his family, play golf and squash, and read non-fiction. He and his wife have two sons.

Awards & Recognition

- 2023 Forbes Best-In-State

- 2022 Forbes Next Generation

- 2022 Forbes Best-In-State

- 2021 Forbes Next Generation

- 2021 Forbes Best-In-State

- 2020 Forbes Next Generation

- 2020 Forbes Best-In-State

- 2019 Forbes Next Generation

- 2019 Forbes Best-In-State

*The awards listed are not endorsement of any third party to invest with IEQ and are not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

The Forbes ranking of Best-in-State Wealth Advisors and America’s Top Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative criteria learned through telephone, virtual and in-person due diligence interviews, and quantitative data such as revenue trends and assets under management. The algorithm additionally weighs factors such as service models, compliance records and industry experience, and focuses on those that encompass best practices in their approach to working with clients. All advisors that are considered have a minimum of seven years experience. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings. More information can be found here: https://lnkd.in/gZnGua5G

The award listed is not an endorsement of any third party to invest with IEQ and is not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

Jeff Westsmith, CFA

Founding Partner

Jeff Westsmith is a Founding Partner of IEQ Capital and has provided investment advice to wealthy families and institutional investors for the past 20 years. He also sits on the Investment Committee at IEQ Capital and oversees the firm’s Research group.

Mr. Westsmith began his career working with high-net-worth families at Fidelity Investments. In 2006, he joined the Private Banking and Investment Group at Merrill Lynch and later co-founded Luminous Capital, an independent Registered Investment Advisory firm. At Luminous Capital, he served as a Financial Adviser and member of the Investment Committee. Luminous Capital managed $5.5 billion of assets when it was acquired by First Republic Bank in 2012. At First Republic Bank, Mr. Westsmith served as a Managing Director and Wealth Manager.

Mr. Westsmith is actively involved in his community. He has served as Treasurer and on the Board of Directors at Windmill School. He is also a supporter and active volunteer with the Boys & Girls Clubs of the Peninsula (BGCP) and Kidsave. Additionally, Mr. Westsmith serves on the iCapital Advisory Council and the advisory boards for BlackRock Secondaries and Liquidity Solutions Fund, TradeLane Properties U.S. Industrial Fund II, and Woodbury Legacy Fund and VTC Fund.

Mr. Westsmith holds a Bachelor of Arts degree from University of California, Los Angeles and has earned the Chartered Financial Analyst (CFA) designation.

Awards & Recognition

- 2023 Forbes Best-In-State

- 2022 Forbes Next Generation

- 2022 Forbes Best-In-State

- 2021 Forbes Next Generation

- 2021 Forbes Best-In-State

- 2020 Forbes Next Generation

- 2020 Forbes Best-In-State

- 2019 Forbes Next Generation

- 2019 Forbes Best-In-State

*The awards listed are not endorsement of any third party to invest with IEQ and are not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

The Forbes ranking of Best-in-State Wealth Advisors and America’s Top Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative criteria learned through telephone, virtual and in-person due diligence interviews, and quantitative data such as revenue trends and assets under management. The algorithm additionally weighs factors such as service models, compliance records and industry experience, and focuses on those that encompass best practices in their approach to working with clients. All advisors that are considered have a minimum of seven years experience. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings. More information can be found here: https://lnkd.in/gZnGua5G

The award listed is not an endorsement of any third party to invest with IEQ and is not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

Jennifer Kowal

Managing Director, Senior Income Tax Strategist

Jennifer Kowal is a Managing Director and Senior Income Tax Strategist at IEQ Capital, where she works with clients to develop comprehensive wealth strategies that integrate tax planning, executive compensation, and estate planning considerations. With over 25 years of experience, she brings a deep technical expertise and a thoughtful, client-focused approach to advising high-net-worth individuals and families.

Prior to joining IEQ Capital, Ms. Kowal served as a Vice President and Banker at J.P. Morgan Private Bank, where she guided clients through complex financial decisions and developed tailored wealth strategies. Previously, she was the Director of the Graduate Tax Program at Loyola Law School for two decades, where she taught and mentored professionals on advanced tax planning. Earlier in her career, Ms. Kowal was Deputy Director of the International Tax Program at Harvard Law School and practiced law at Irell & Manella LLP and Ropes & Gray LLP, specializing in the taxation of business transactions, cross-border structures, partnerships, and corporate entities.

Ms. Kowal is actively involved in her community, serving on the Advancement and Finance Committees of the Caltech Y and as a member of the Professional Advisors Committee of the Pasadena Community Foundation.

Ms. Kowal holds a Juris Doctor from the University of California, Los Angeles School of Law, where she was a member of the Order of the Coif, and a Bachelor of Science in Business and Accounting from the University of Kansas.

Ms. Kowal resides in South Pasadena, where she enjoys running, spending time with family and friends, and reading contemporary literature.

It is important to remember that IEQ and its employees do not provide tax, legal, or other advice. Clients should consult with their legal and tax advisors regarding their personal circumstances.

Jennifer Young

Managing Director

Jennifer Young is a Managing Director of IEQ Capital and has provided investment advice to wealthy families and institutional investors for nearly 20 years.

Ms. Young began her career as a Client Associate at Merrill Lynch PBIG followed by eight years at Morgan Stanley. She joined First Republic Bank as a Director before transitioning to IEQ Capital in 2019 to help develop the firm and continue her career in financial services.

Ms. Young holds a Bachelor of Science in Spanish Literature from Loyola Marymount University.

Ms. Young resides in Los Angeles, California with her husband and daughter.

Awards & Recognition

- 2023 Best-in-State Wealth

*The awards listed are not endorsement of any third party to invest with IEQ and are not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

Forbes' wealth advisor ranking is developed by SHOOK Research, an independent research firm. The ranking is based on an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. Those advisors that are considered have a minimum of seven years' experience, and the algorithm weighs factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings. More information can be found here.

*The awards listed are not endorsement of any third party to invest with IEQ and are not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing. The Forbes ranking of America’s Top Wealth Advisors and Best-In-State Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative criteria learned through telephone, virtual and in-person due diligence interviews, and quantitative data such as revenue trends and assets under management. The algorithm additionally weighs factors such as service models, compliance records and industry experience, and focuses on those that encompass best practices in their approach to working with clients. All advisors that are considered have a minimum of seven years experience. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings. More information can be found here.

Jeremy Wenner

Senior Managing Director

Jeremy Wenner is a Senior Managing Director of IEQ Capital and has provided investment advice to wealthy families and institutional investors for over 25 years.

Prior to joining IEQ Capital, Mr. Wenner was a Managing Director and Wealth Manager at First Republic Investment Management which he joined in 2018. Prior to joining First Republic, Mr. Wenner was a wealth advisor at Jefferies LLC and Thomas Weisel Partners where he specialized in the design and implementation of equity and balanced portfolios for high-net-worth individuals and families. Mr. Wenner started his career in financial services at NationsBanc Montgomery Securities in 1998 before joining SF Sentry, a multifamily office.

Mr. Wenner currently serves as a mentor for 10,000 degrees, a nationally recognized leader in supporting students from low-income backgrounds to and through college and beyond.

Mr. Wenner has been recognized as a 2022 & 2023 Best-in-State Wealth Advisor by Forbes.

Mr. Wenner received a Bachelors of Arts in Political Science from Colgate University. He received his Master in Business Administration from UC Berkeley Haas School of Business.

Mr. Wenner currently resides in Marin County with his wife and three children. He enjoys skiing, surfing, biking and soccer.

Awards & Recognition

- 2023 Best-in-State Wealth

*The awards listed are not endorsement of any third party to invest with IEQ and are not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing.

Forbes' wealth advisor ranking is developed by SHOOK Research, an independent research firm. The ranking is based on an algorithm of qualitative criteria, mostly gained through telephone and in-person due diligence interviews, and quantitative data. Those advisors that are considered have a minimum of seven years' experience, and the algorithm weighs factors like revenue trends, assets under management, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings. More information can be found here.

*The awards listed are not endorsement of any third party to invest with IEQ and are not indicative of future performance. Investors should not rely on awards for any purpose and should conduct their own review prior to investing. The Forbes ranking of America’s Top Wealth Advisors and Best-In-State Wealth Advisors, developed by SHOOK Research, is based on an algorithm of qualitative criteria learned through telephone, virtual and in-person due diligence interviews, and quantitative data such as revenue trends and assets under management. The algorithm additionally weighs factors such as service models, compliance records and industry experience, and focuses on those that encompass best practices in their approach to working with clients. All advisors that are considered have a minimum of seven years experience. Portfolio performance is not a criterion due to varying client objectives and lack of audited data. Neither Forbes nor SHOOK receive a fee in exchange for rankings. More information can be found here.

Jesse Wood

Partner

Jesse Wood is a Partner of IEQ Capital and has provided investment advice to high-net-worth families and institutional investors for 20 years.

Mr. Wood began his career as an Advisor with Goldman Sachs in 2002 where he worked in the Fixed Income division covering institutional clients across the country. After ten years at Goldman Sachs, Mr. Wood joined JP Morgan where he served as a Senior Banker in the Private Bank. Prior to joining IEQ Capital, Mr. Wood served as the Head of the West Coast for BBR Partners where he worked with high-net-worth families and individuals creating customized solutions for their financial needs.

Mr. Wood holds a Bachelor of Arts with a concentration in Economics from Brown University where he was also a two-time captain of the men’s basketball team. He has served on the board of The D10 and he currently serves on the Advisory Board for PeacePlayers International.

Mr. Wood loves to spend time with his family and play basketball and golf in his spare time. He and his wife have two sons and a daughter together.

Jimmy Morris, CFA

Managing Director

Jimmy Morris is a Managing Director of IEQ Capital and has worked with entrepreneurs, family offices and institutions across various investment-related capacities for over 15 years.

Mr. Morris began his career with Cambridge Associates in Boston, Massachusetts, advising endowments, foundations and family offices on manager sourcing and due diligence in the hedge fund and private equity space. Following his desire to work more closely with private clients, he began his career at JPMorgan Private Bank in 2012, where he helped run the investment team responsible for asset allocation strategy as well as opportunistic and private investment implementation. In 2019, he was presented with the opportunity to establish the Private Bank office for Citigroup, where he and his team focused on advising entrepreneurs, family offices and private businesses on investment, estate planning and structuring matters across their complex balance sheets.

Mr. Morris currently serves on the corporate board for Boys and Girls Club of Metro Atlanta and is an active member in the Greek Orthodox Cathedral of the Annunciation.

Mr. Morris holds a Bachelor of Science degree in Finance and Statistics from Miami University (Ohio). He holds the Chartered Financial Analyst designation.

Mr. Morris lives in Atlanta, Georgia with his wife and two children. In his spare time, he enjoys playing golf, reading and watching college football.

John MacLean

Director

John MacLean is a Director of IEQ Capital and has provided investment advice to wealthy families and institutional investors for over five years. Mr. MacLean began his career in the Portfolio Management Group at Hall Capital Partners before transitioning to IEQ Capital in 2022.

Mr. MacLean serves on the Grants Committee for the Olympic Club Foundation, an organization that supports and encourages participation of Bay Area youth in amateur athletics.

Mc. MacLean holds a Bachelor of Arts in Economics with citations in Psychology and Spanish Language from Harvard University where he was also a member of the Division 1 baseball team.

John Micek IV

Managing Director

John Micek IV is a Managing Director at IEQ Capital and has over two decades of experience in the financial services industry.

Prior to joining IEQ, Mr. Micek was a Managing Partner at Third Leaf Partners, a beverage and hospitality industry investment and advisory company. From 2012 to 2018, Mr. Micek was a Partner and held roles including Chief Operating Officer and Head of Business Development at Criterion Capital Management, an equity long/short technology hedge fund. Before joining Criterion in 2012, Mr. Micek was a Vice President at Goldman Sachs & Co. in the Capital Introduction Group.

Mr. Micek is a Member of the Board of Directors of the Navy SEAL Foundation, and a Trustee of the Naval Postgraduate School Foundation. Formerly, he served as Chair of the Community Activities Commission for the City of Carmel-by-the-Sea, and as a Member of the Board of Directors of Circle Systems, Inc., a cybersecurity company.

Mr. Micek received a Bachelor of Business Administration in Finance from the University of Notre Dame in South Bend, Indiana, where he was a member of the Varsity Golf Team during his freshman year and was elected Junior Class President.

Mr. Micek and his wife Noelle reside in Carmel, California, with their two children, Charlotte and John J. Micek V (Jack). In addition to their respective careers, the Micek's Co-founded The Red Stitch Wine Group, an acclaimed Napa Valley Winery in 2009.

John Stone

Partner

John Stone is a Partner at IEQ Capital and manages a team of 25 investment professionals to support the growth of the business and team.

Prior to joining IEQ Capital, Mr. Stone spent 10 years at First Republic Bank where he served as a Senior Vice President and Deputy Head of First Republic Securities Company where his leadership responsibilities focused on the overall management, strategy, growth and operating results of FRSC, FRSC products and service strategy. Prior to joining First Republic Bank in May of 2012, Mr. Stone spent over 10 years at Stone & Youngberg LLC specializing in all areas of operations, trade operations and compliance.

Mr. Stone graduated with honors from the University of San Francisco with a Bachelor of Science degree in Applied Economics.

He is a Bay Area native and resides in San Mateo, California with his wife and two sons.

Jonathan Barnes

Director

Jonathan Barnes is a Director at IEQ Capital and has worked in the finance industry for nearly a decade.

He began his career at UBS before working at Jefferies. Prior to joining IEQ Capital, Mr. Barnes spent five years at First Republic Private Wealth where he provided investment advice to clients.

Mr. Barnes holds a Bachelor of Science in International Business from the University of Nevada, Reno.

He currently resides in San Francisco, California.

.jpg)

Joyce Cheng

Associate Director

Joyce Cheng is an Associate Director of Wealth Management at IEQ Capital and has provided investment planning advice to high-net-worth and ultra-high-net-worth individuals for four years.

Ms. Cheng began her career at ABM Industries as an FP&A analyst. She then transitioned to a Financial Advisor at Citigroup and Morgan Stanley. In 2023, Ms. Cheng joined IEQ Capital as an Associate Director to continue providing investment services to wealthy families.

Ms. Cheng is actively involved with non-profit organizations to promote DEI in the workplace. She serves as a program chair for Her Allies and is a committee member of How Women Lead. She is also a member of IEQ Capital’s DEI committee.

Ms. Cheng holds a Bachelor of Science in Business Administration with a concentration in Finance from the University of the Pacific and a Master of Science in Quantitative Risk Management from Columbia University.

Ms. Cheng lives in Burlingame, California with her husband Joey and their golden retriever Jack. She enjoys traveling and hiking with her family.

Katia Stern, CFP

Director

Katia Stern is a Director of IEQ Capital who has provided investment advice to wealthy families and institutional investors for nearly a decade.

Ms. Stern began her career at Santa Barbara based firm, West Coast Financial, where she provided investment advice and financial planning to individuals and to families along with serving on the Equity Research Committee.

Ms. Stern holds a Bachelor of Science degree in Statistical Science from University of California, Santa Barbara. She is also a Certified Financial Planner™

Ms. Stern currently resides in San Francisco, California. In her free time, Ms. Stern enjoys running, hiking, exploring new restaurants, and traveling.

Kevin Burt, CFA, CFP

Senior Director

Kevin Burt is a Senior Director at IEQ Capital and has provided investment advice to wealthy families and institutional investors for over a decade.

Mr. Burt began his career with Blackstone and RBC Capital Markets where he specialized in alternative asset management. He then joined the Private Banking Group at Credit Suisse before transitioning to First Republic Bank in 2016. In 2019, Mr. Burt joined IEQ Capital to continue his career in financial services.

Mr. Burt holds a Bachelor of Arts degree in Business Economics from the University of California, Santa Barbara. He is a Chartered Financial Analyst®, a Certified Financial Planner™, and a member of the CFA Society of San Francisco, California.

Mr. Burt currently resides in Sonoma County with his wife, pets, and son. In his free time, Mr. Burt enjoys traveling, hiking, wine tasting, and playing golf.

Kevin Loveland

Director

Kevin Loveland is a Director at IEQ Capital and he has worked in the financial industry for over a decade.

Prior to joining IEQ Capital, Mr. Loveland was at First Republic Bank, where he most recently served as a Managing Director. While at First Republic Bank, Mr. Loveland honed his banking expertise, serving ultra-high net worth families, venture capital firms, and startup/tech banking, ultimately overseeing a $1B+ portfolio while leading a successful team of bankers.

Mr. Loveland earned a degree in Business Administration, Finance from San Jose State University, graduating with Honors.

He resides in Portola Valley with his wife and daughter, and in his spare time you’ll find him pursuing his passion for golf.

Kevin Lyle

Associate Director

Kevin Lyle is an Associate Director at IEQ Capital and has provided investment and financial planning advice to wealthy families and individuals for nearly a decade.

Mr. Lyle began his career specializing in financial planning at SageCrest Wealth Management. He later transitioned to a wealth advisor role at the firm, where he provided investment and planning advice to individual and families.

Mr. Lyle holds a Bachelor of Science in Business, with a concentration in Finance from the University of Oregon.

In his free time, Mr. Lyle enjoys traveling, skiing, golfing, and following Bay Area sports teams.

Mr. Lyle currently resides in San Francisco, California with his wife, Marissa, and their dog, Henry.

Kim Conley

Director, Chief of Staff

Kim Conley is a Director at IEQ Capital, managing the Executive Support Team, as well as fulfilling the Chief of Staff role for Co-Founder and Managing Partner, Eric Harrison.

Ms. Conley has over two decades of experience working in management across several industries including operations, client services, finance, and human resources. Prior to joining IEQ, she filled the title of Department Head for three firm departments in addition to holding the Director of Client Services title at a previous RIA.

Ms. Conley obtained her Master of Business Administration (MBA) degree at the top of her class from Aalto University in Helsinki, Finland. She also has a Bachelor’s degree in Finance and Management from Western University in London, Canada.

Outside of her professional career, Ms. Conley is an active volunteer in her local early education community, serving on various positions within the PTA. She also enjoys hiking, reading, and traveling. She grew up on a farm in Canada and lived in Europe for six years.

She currently resides in Dublin, California with her husband and two kids.

Kyle Wills

Associate Director

Kyle Wills is an Associate Director of IEQ Capital, where he provides investment advice to wealthy families and institutional investors.

Mr. Wills has over six years of wealth management experience, having begun his career with North Star Resource Group, an independent advisory firm in his hometown of San Diego, California.

Mr. Wills is an active volunteer within his community and the American Lung Association.

Mr. Wills holds a Bachelor of Arts degree in Biopsychology from the University of California, Santa Barbara, and he currently resides in Manhattan Beach, California.

Larry Chew

Associate Director

Larry Chew is an Associate Director at IEQ Capital, brining over a decade of experience in data engineering, data science, business intelligence, and cloud platforms. Mr. Chew supports the firm's technology initiatives, delivering innovative solutions to enhance its digital infrastructure and data-driven capabilities.

Before joining IEQ Capital, Mr. Chew began his career as an IT Operator with The Walt Disney Company, where he soon transitioned into a Business Intelligence Analyst role. Mr. Chew further developed his expertise in business intelligence and technological innovation through various roles across the medical and technology sectors.

Mr. Chew holds a Bachelor’s degree in Music Performance (Viola) from UCLA and resides in the Bay Area.

Lauren Menagh

Associate Director

Lauren Menagh is an Associate Director at IEQ Capital on the Human Capital team. In her role, she supports the firm through a focus on new office opening and facilities management.

Throughout Ms. Menagh's career, she has worked in both the nonprofit sector and corporate finance sector, supporting business operations and Human Capital functions. Prior to joining IEQ Capital, she worked on the operations team for a global health nonprofit.

Outside of work, Ms. Menagh is passionate about volunteering with Beyond Celiac, a cause very important to her. She was also formerly a member of the Rotary Club of Sausalito. She also love set aside time to enjoy nature, practice yoga, and work on her gluten-free cooking and baking skills.

Ms. Menagh received her Bachelor of Arts in Psychology and French from University of California, Davis.

Ms. Menagh currently lives with her fiancé in San Francisco, California.

Leon Baer

Senior Director

Leon Baer is a Senior Director of IEQ Capital and has provided investment advice to wealthy families and institutional investors since 2017.

Mr. Baer began his career working with high-net-worth individuals at First Republic Bank. In 2019, Mr. Baer transitioned to IEQ Capital as a founding team member and helped develop the firm while furthering his career in financial services.

Mr. Baer is an active volunteer and supporter of the United Way Bay Area.

Mr. Baer holds a Bachelor of Business Administration and Master of Science in Sustainability Management from the Kogod School of Business at American University, where he was a member of the Division I Men’s Basketball Team. Prior to American University, Mr. Baer attended the University of Connecticut, where he was also a member of the Basketball Team and won the NCAA National Championship in 2014.

Mr. Baer is a Berlin, Germany, native and resides in San Francisco, California, with his wife.

Lior Keshet, J.D.

Partner, Chief Compliance Officer & General Counsel

Lior Keshet is a Partner, the General Counsel and the Chief Compliance Officer at IEQ Capital. Mr. Keshet has nearly two decades of legal and regulatory experience in the financial services industry.

Prior to joining IEQ Capital, Mr. Keshet was at Paul Hastings LLP where he advised private pooled investment funds, investment advisors, and investment companies on all aspects of their organization, registration, and operation, including regulatory and compliance matters. Prior to that, Mr. Keshet served as the General Counsel and Chief Compliance Officer of two prominent Los Angeles based investment firms. Mr. Keshet started his career at Sidley Austin LLP, where he was a member of the investment products and derivatives group.

Mr. Keshet graduated Summa Cum Laude from both Loyola Law School, where he earned his J.D., and Eastern Michigan University, from where he received a Bachelor of Arts in communications.

Meena Karamcheti

Associate Director

Meena Karamcheti is an Associate Director at IEQ Capital, where she has provided investment advice to wealthy families and institutional investors for nearly five years.

Ms. Karamcheti first joined IEQ Capital as an intern in 2019. In 2021, Ms. Karamcheti transitioned to a full-time employee post-graduation. In addition to her client-facing role, Ms. Karamcheti is deeply involved in IEQ’s internal initiatives. She serves as the chair of the Diversity, Equity, and Inclusion (DEI) Recruiting Subcommittee and is an active member of various internal groups focused on firm development.

Ms. Karamcheti graduated summa cum laude with a Bachelor of Science in both Psychology and Economics from Tufts University.

She is originally from New York and currently resides in the Bay Area of California.

Megan Whyte

Partner, Chief Client Officer